Bitcoin mining employs specialized computers (ASICs) to solve complex cryptographic puzzles in a competitive race, validating transactions while securing the blockchain. Miners hash pending transactions into Merkle trees, attempting to find a valid block approximately every ten minutes. Successful miners receive newly minted bitcoins plus transaction fees—a rather elegant incentive structure that eliminates financial intermediaries. This computational arms race consumes staggering amounts of energy, prompting operations to cluster near cheap electricity sources. The nuances of this digital gold rush extend far beyond mere number-crunching.

How exactly does one “mine” a digital currency that exists solely in the ether of the internet?

Bitcoin mining—a term that conjures images of pickaxes and gold pans, yet manifests as rows of humming computers—forms the backbone of the cryptocurrency’s ecosystem.

This process involves validating transactions and adding them to the blockchain, a public ledger that maintains an immutable record of all Bitcoin activity.

The mining process operates via a Proof-of-Work consensus algorithm, wherein miners (who might be individuals or vast corporate entities with warehouse-sized operations) compete to solve complex cryptographic puzzles.

Bitcoin miners, from solo enthusiasts to industrial behemoths, battle in a computational arena to crack cryptographic codes and claim their digital gold.

These mathematical challenges, while intellectually straightforward, require brute computational force—hence the staggering energy consumption that has environmentalists wringing their hands.

Miners hash transactions in pairs using Merkle trees until they create a Merkle root for inclusion in each block.

Every ten minutes, on average, a miner somewhere triumphs in this digital lottery, earning the right to add a new block to the blockchain.

Their reward? Newly minted bitcoins plus transaction fees—a rather elegant incentive structure that simultaneously secures the network and distributes new currency.

One might call it capitalism distilled to its essence.

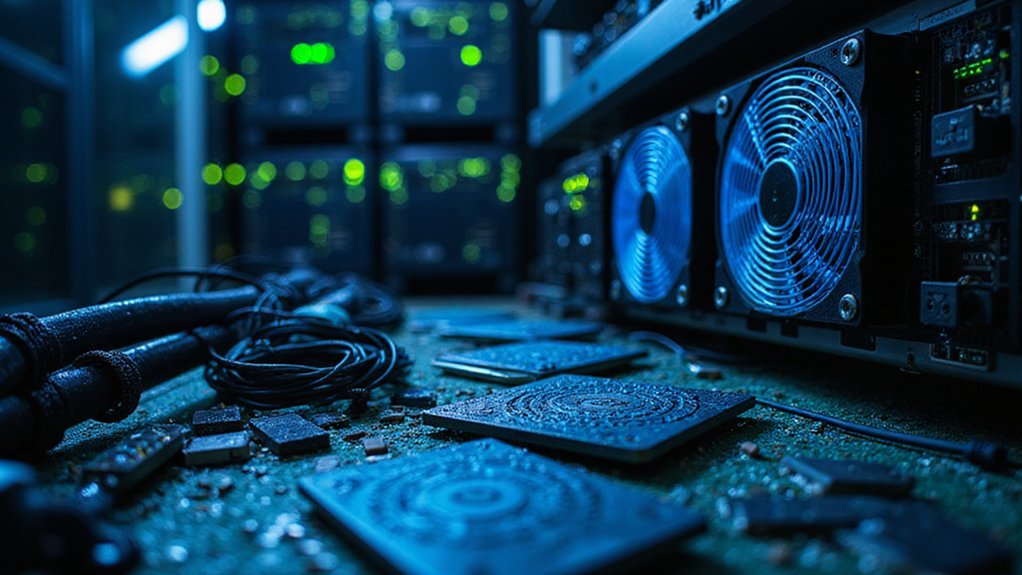

The equipment required has evolved dramatically from the network’s early days when enthusiasts could mine from personal computers.

Now, specialized Application-Specific Integrated Circuits (ASICs) dominate the landscape, rendering consumer-grade hardware effectively obsolete.

These machines generate substantial heat, necessitating elaborate cooling systems that further compound energy demands.

This decentralized verification system eliminates the need for trusted third parties like banks or payment processors.

Instead, miners worldwide—from Icelandic geothermal operations to Chinese hydroelectric ventures—continuously validate transactions.

The network adjusts puzzle difficulty based on total computational power, ensuring blocks maintain their ten-minute cadence regardless of technological advances.

Each time a new block is added, it serves as a double-spend prevention mechanism that maintains the integrity of all previous transactions.

As Bitcoin’s predetermined supply cap approaches (21 million coins), mining rewards will gradually shift toward transaction fees exclusively.

This shift represents perhaps the most ambitious economic experiment of our digital age—can a self-regulating system maintain security when its primary reward mechanism fundamentally changes?

The success of a miner’s efforts largely depends on competing against others who collectively generate trillions of hashes per second in their quest to find a value below the target hash.

The complexity of these puzzles undergoes regular adjustments to ensure the mining difficulty remains proportional to the total computational power devoted to the network.

Frequently Asked Questions

What Environmental Impact Does Bitcoin Mining Have?

Bitcoin mining exacts a hefty environmental toll through its voracious energy consumption—predominantly from fossil fuels—generating significant greenhouse gas emissions (over 68 MtCO2E in 2022).

This digital gold rush contributes to air pollution, exposing millions to increased PM2.5 levels, while straining water resources and altering landscapes in mining hotspots.

Despite proposals ranging from carbon offsets to renewable energy integration, Bitcoin’s environmental footprint remains substantial enough to potentially undermine Paris Agreement climate goals without significant intervention.

How Much Electricity Does Mining a Single Bitcoin Consume?

Mining a single Bitcoin consumes approximately 6.4 million kilowatt-hours of electricity—equivalent to powering 61 American homes for a year or driving a Tesla Model 3 around Earth 86 times.

This astronomical energy expenditure (which varies by geography) explains why profitable mining operations cluster in regions with subsidized electricity costs, creating a peculiar arbitrage opportunity where environmental externalities are effectively monetized through regulatory disparities.

Post-halving events, these figures paradoxically trend upward despite reduced rewards.

Is Bitcoin Mining Legal Worldwide?

Bitcoin mining’s legal status varies dramatically worldwide. While permitted in the United States and Canada (though with provincial restrictions), China executed a total ban in 2021. India remains in regulatory limbo—neither explicitly prohibiting nor sanctioning the practice. Various nations implement restrictions based on energy concerns rather than the activity itself.

Ironically, some jurisdictions that decry mining’s environmental impact simultaneously court its economic benefits, creating a regulatory tapestry that miners must navigate with increasing sophistication and, occasionally, legal counsel.

Can Mining Damage My Computer Hardware Over Time?

Mining can indeed ravage computer hardware, particularly consumer-grade equipment not designed for such computational marathons.

The relentless workload forces GPUs and CPUs to operate at maximum capacity for extended periods, generating excessive heat that accelerates component degradation.

Power supplies endure constant strain, while cooling systems struggle to maintain viable temperatures.

For the uninitiated who venture into mining with standard hardware, the outcome often resembles a pyrrhic victory—a modest crypto yield at the expense of dramatically shortened hardware lifespan.

How Has Bitcoin Mining Profitability Changed Since Its Inception?

Bitcoin mining profitability has undergone seismic shifts since its inception.

Early miners enjoyed astronomical returns using basic hardware and minimal electricity, effectively printing money with their laptops.

The landscape transformed dramatically with ASIC integration, exponential difficulty increases, and block reward halvings.

Today’s miners operate on razor-thin margins, requiring industrial-scale operations, access to cheap electricity, and sophisticated financial strategies just to remain solvent—a far cry from the gold rush days when hobbyists could mine meaningful quantities from their bedrooms.