How swiftly the crypto faithful discovered that political promises, much like blockchain transactions, can be irreversible—though not always in the intended direction.

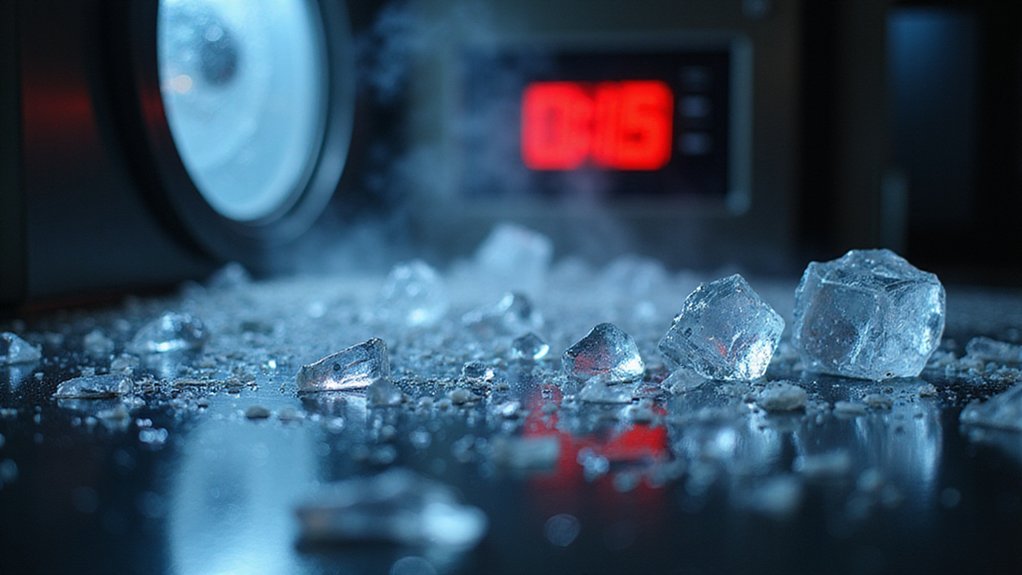

The cryptocurrency market’s spectacular $1.3 trillion evaporation since Trump’s inauguration serves as a sobering reminder that political theater and market fundamentals often operate on entirely different frequencies.

Bitcoin’s precipitous descent from record highs to below $75,000 illustrates the peculiar paradox of Trump’s crypto agenda: promises of financial liberation have instead delivered wealth concentration among elites.

The promised democratization of finance has instead crystallized into yet another mechanism for elite wealth accumulation.

The irony is palpable—a populist movement championing decentralization has produced distinctly centralized outcomes, benefiting precisely those who needed no additional financial advantages.

The Liberation Day tariffs (an oxymoron worthy of Orwell himself) catalyzed broader market turmoil, demonstrating how traditional economic policies can devastate supposedly independent digital assets.

This interconnectedness exposes the fundamental delusion that cryptocurrency exists in some hermetically sealed economic ecosystem, immune to political machinations and conventional market forces.

Many traders scrambled to acquire base cryptocurrencies through major exchanges like Binance and Coinbase to swap for alternative assets as traditional crypto investments faltered.

Environmental concerns compound the crisis, as energy-intensive mining operations continue expanding despite mounting sustainability pressures.

The crypto industry’s carbon footprint—already substantial enough to power small nations—faces increasing scrutiny from communities bearing the health costs of environmental degradation.

Mining operations now require water equivalent to what thousands of households consume annually, straining precious natural resources in already vulnerable regions.

Resource depletion and ecosystem strain represent externalized costs that market prices stubbornly refuse to internalize.

Regulatory uncertainty perpetuates volatility, creating a feedback loop where political interference breeds market instability, which then justifies further political intervention.

Trump’s influence over crypto policies exemplifies how individual actors can manipulate entire sectors, raising uncomfortable questions about market manipulation and democratic governance of financial systems.

Trump’s meme coin launch created devastating losses as $TRUMP and $MELANIA tokens lost $2 billion in value, further complicating regulatory landscapes while legitimizing speculative digital assets.

The broader implications extend beyond immediate price movements.

Wealth concentration threatens to exacerbate economic inequality, while job market disruption looms as traditional employment faces displacement from automated systems.

Innovation potential remains, yet current trajectories suggest technological progress may benefit narrow constituencies rather than promoting genuine financial inclusion.

International coordination failures compound domestic regulatory gaps, creating arbitrage opportunities for bad actors while penalizing legitimate participants.

The resulting instability poses systemic risks to global financial architecture—a sobering prospect considering cryptocurrency’s original promise to enhance, rather than threaten, economic stability.